|

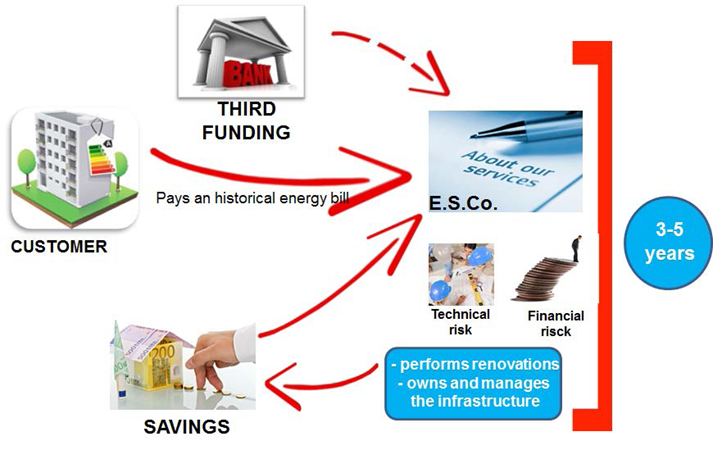

ENERGY PERFORMANCE CONTRACT MODELS |

| CONTRAC TYPE | FIRST OUT | ||

| SCHEME OF THE CONTRACT |

source: ASSISTAL |

||

| GENERAL INFORMATION | CUSTOMER |

─ For the duration of the contract the customer continues to spend like before upgrading the energy efficiency ─ At the end of the contract the customer benefits of the savings resulting from energy saving measures |

|

| ESCO |

─ ESCO finances the interventions with equity capital or through third Party Financing ─ For the duration of the contract, receives 100% of the savings achieved by energy saving measures by which the ESCO can recover the credit, the costs and the profit |

||

| BANK | ─ The Bank finances the ESCO if not use the equity | ||

| SWOT ANALYSIS | STRENGTHS |

─ Good performance incentives for the ESCO ─ The Public Administration should not raise initial capital, has a standard bill and then a standard spending, both the financial risks that the technical ones are cared for by the ESCO |

|

| WEAKNESSES |

─ The Public Administration gets the savings only a few years after the start of the contract ─ The ESCO owns the entire financial risk |

||

| OPPORTUNITY | ─ Short time return that let you find more competition in the market | ||

| THREATS | ─ Perception of lack of savings for the first few years in the face of immediate benefits for the private sector | ||

| LEARN MORE | |||