|

\r\n

ENERGY PERFORMANCE \r\n CONTRACT MODELS \r\n |

||

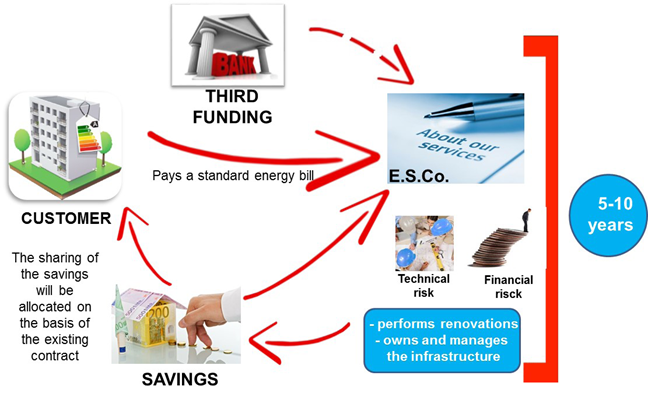

| CONTRAC TYPE | SHARED SAVINGS | ||

| SCHEME OF THE CONTRACT | \r\n\r\n \r\n \r\n

source: ASSISTAL \r\n |

||

| GENERAL INFORMATION | CUSTOMER | ─ Energy saving is divided between ESCO and the customer | |

| ESCO | \r\n

─ ESCO finances interventions with equity capital or through third Party Financing \r\n ─ The ESCO accepts the risk to the guaranteed performance (“technical risk”) and accepts the “credit risk” \r\n ─ Energy saving is divided between ESCO and the customer \r\n |

||

| BANK | ─ The Bank finances the ESCO if not use the equity | ||

| SWOT ANALYSIS | STRENGTHS | \r\n

─ Return balanced investment between the customer and the ESCO \r\n ─ Both parties will immediately benefit from the savings while only the ESCO assumes the technical and financial risks \r\n |

|

| WEAKNESSES | ─ The duration of the medium-long term of this contract could be a problem for some ESCO rather than for the Public Sector | ||

| OPPORTUNITY | ─ Good incentive to the result: the higher the energy saving and the higher the gain for customer and ESCO | ||

| THREATS | \r\n

─ First savings on energy bills relatively low \r\n ─ Problem of financing for the ESCO for early gains low \r\n |

||

| LEARN MORE | http://iet.jrc.ec.europa.eu/energyefficiency/european-energy-service-companies/energy-performance-contracting | ||